how to calculate my paycheck in michigan

Overview of Michigan Taxes. Start with pay type and select hourly or salary from the dropdown menu.

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Switch to salary Hourly Employee.

. Calculate your Michigan net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Michigan paycheck calculator. Switch to Michigan hourly calculator. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you.

Penalty and Interest Calculator Follow us. Supports hourly salary income and multiple pay frequencies. You can choose between weekly bi-weekly semi-monthly monthly quarterly semi-annual and annual pay periods and between single married or head of household.

Change state Check Date General Gross Pay Gross Pay Method. PENALTY Penalty is 5 of the total unpaid tax due for the first two months. How Your Paycheck Works.

Benefits paid unpaidunderpaid taxes and a fluctuating payroll can all cause a. Choose Cycle Daily Weekly Bi-Weekly Monthly Semi-Monthly Quarterly Semi-Annually Annually Miscellaneous. It is not a substitute for the advice of an accountant or other tax professional.

Calculating your Michigan state income tax is similar to the steps we listed on our Federal paycheck calculator. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Multiply the number of hours worked by the employees hourly pay rate.

When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. After a few seconds you will be provided with a full breakdown of the tax you are paying. Add the employees pay information You should see fields that say pay type pay rate hours worked pay date and pay period.

See the results for Payroll calculator mi in Michigan. For single filer you will receive 282496 every month after federal tax liability. The maximum late penalty is equal to 25 of the unpaid tax owed.

If the employee is hourly input their hourly wage under pay rate and fill in the number of hours they worked that pay period. Make sure to calculate any. INTEREST Interest is calculated by multiplying the unpaid tax owed by the current interest rate.

Total annual income - Tax liability All deductions Withholdings Your annual paycheck How much is a paycheck on 40000 salary. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Michigan Overtime Wage Calculator.

Choose Marital Status Single or Dual Income Married Married one income Head of Household. Up to 32 cash back Federal Payroll Taxes. Gross wages represent the amount of money an employee has earned during the most recent pay period.

After two months 5 of the unpaid tax amount is assessed each month. Check if you have multiple jobs. Taxable Income in Michigan is calculated by subtracting your tax deductions from your gross income.

This online paycheck calculator with overtime and claimed tips will estimate your net take-home pay after deductions and federal state and local income tax withholding. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay.

For married filed joinly with no dependent the monthly paycheck is 296083 after federal tax liability. Michigans Unemployment System Michigan has an experienced-rated tax system that uses the employers payroll unemployment taxes the employer paid and unemployment benefits charged to the employers account to calculate the employers annual tax rate. Figures entered into Your Annual Income Salary should be the before-tax amount and the result shown in Final Paycheck is the after-tax amount including deductions.

Next divide this number from the annual salary. Figure out your filing status work out your adjusted gross income Total annual income Adjustments Adjusted gross income calculate your taxable income Adjusted gross income. Michigan is a flat-tax state that levies a state income tax of 425.

State Date State Michigan. Calculate your Michigan net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Michigan paycheck calculator. Enter any overtime hours you worked during the wage period you are referencing to calculate your total overtime pay.

For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000. How to calculate taxes taken out of a paycheck. Estimate your paycheck withholding with TurboTaxs free W-4 Withholding Calculator.

Incredibly a lot of people fail to allow for the income tax deductions when completing their annual tax return inMichigan the net effect for those individuals is a higher state income tax bill in Michigan and a higher Federal tax bill. For example if an employee has a salary of 50000 and works 40 hours per week the hourly rate is 500002080 40 x 52 2404. Switch to Michigan salary calculator.

This Michigan hourly paycheck calculator is perfect for those who are paid on an hourly basis. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

Calculates Federal FICA Medicare and withholding taxes for all 50 states. This free easy to use payroll calculator will calculate your take home pay. To use our Michigan Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

In Michigan overtime hours are any hours over 40 worked in a single week. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52. The most popular methods of earning.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Michigan. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. Federal labor law requires overtime hours be paid at 15 times the normal hourly rate.

How do I calculate hourly rate. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Michigan residents only. Number of Qualifying Children under Age 17.

For instance a person who lives paycheck-to-paycheck can calculate how much they will have available to pay next months rent and expenses by using their take-home-paycheck amount.

Michigan Paycheck Calculator Updated For 2022

Leo Can A Person Work Part Time And Still Collect Ui Benefits

Successaesthetics Bullet Journal Inspiration Bullet Journal Journal Inspiration

State Of Michigan Taxes H R Block

Michigan Sales Tax Calculator Reverse Sales Dremployee

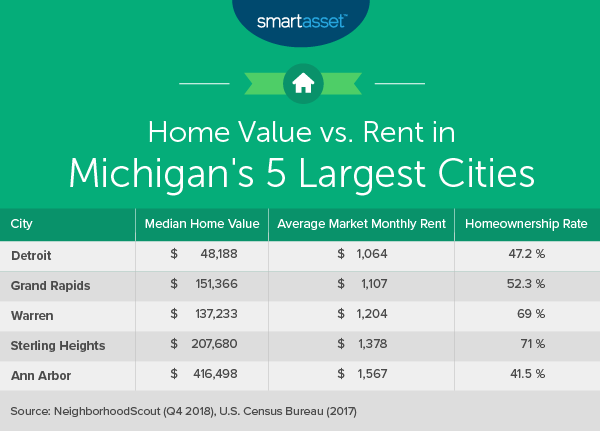

Michigan Income Tax Calculator Smartasset

Michigan Medicaid Income Limits 2021 Medicaid Nerd

Michigan Salary Calculator 2022 Icalculator

Michigan Wage Calculator Minimum Wage Org

2021 Benefits Wellness Virtual Expo Human Resources Western Michigan University

Paying For College Mid Michigan College

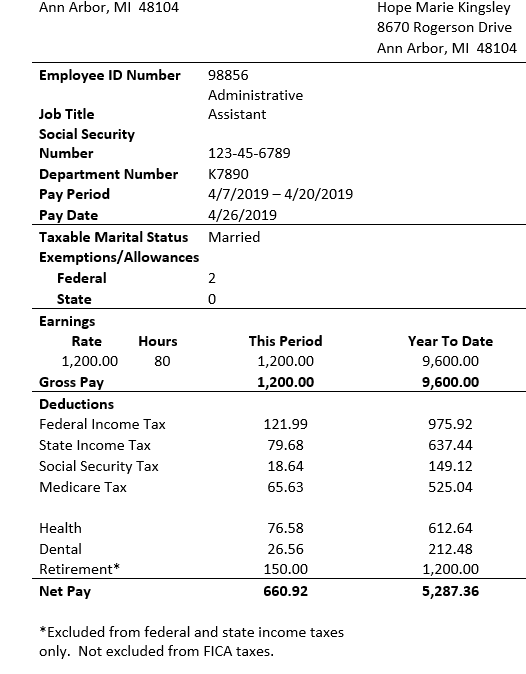

For The Federal And State Taxes The Retirement Is Chegg Com

Background Check Expert Explains Problems With Michigan Dob Redaction Employment Screening Resources

7 06 02 Reporting Employees Who Are New To Mpsers

An Example Of A W 4 Form And About How To Fill Out Various Important Sections Best Tax Software Online Taxes Tax Refund

2020 Michigan Good Food Virtual Summit Launch Session Msu Mediaspace